BLOG

Trans Union Backdoor Method

The Transunion BackDoor Method

Today I am going to teach you another technique that is meant to quickly improve your credit score. This is a way that you can get certain blemishes off your Transunion credit report. Specifically:

Personal identification issues (phone numbers, addresses, employment information, incorrect spellings, etc.)

Collections or Derogatory remarks

Late payments can sometimes be fixed, but this is less common

For most people, you will still want to do a sweep of your data; however, this is a fast technique to get some of the items corrected quickly.

Note that this technique is not available to remove hard inquiries from your Transunion credit report. There is not even an option to do so using this method; you will have to conduct a credit sweep to remove those.

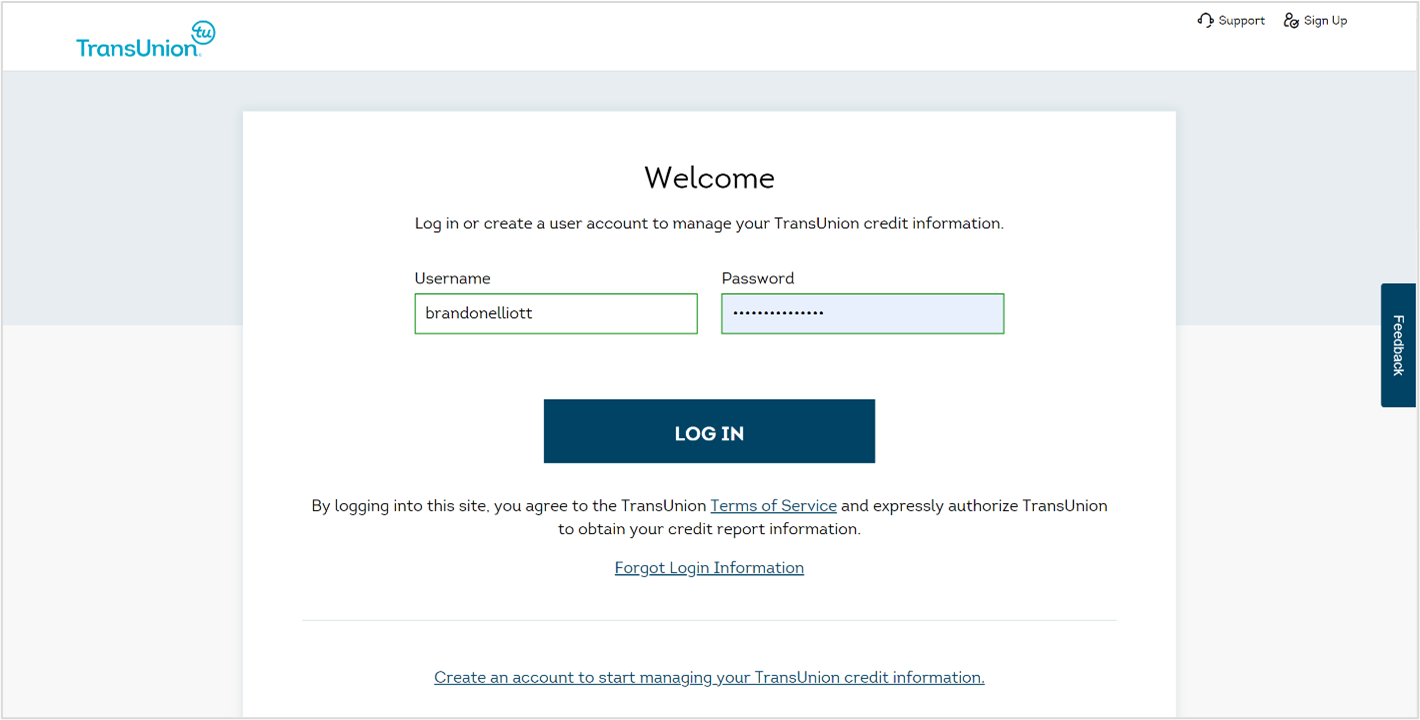

If you have not already done so, you can create a new FREE TransUnion account here:

https://service.transunion.com/dss/orderStep1_form.page

Once your FREE account is created, you will have to log in here:

https://service.transunion.com/dss/login.page

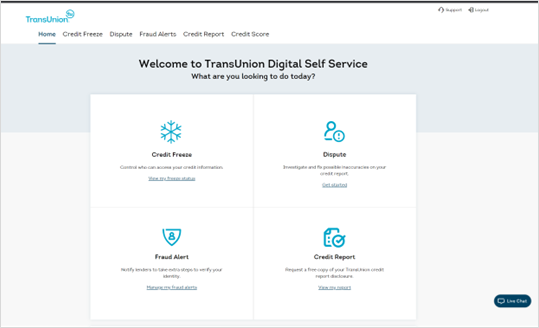

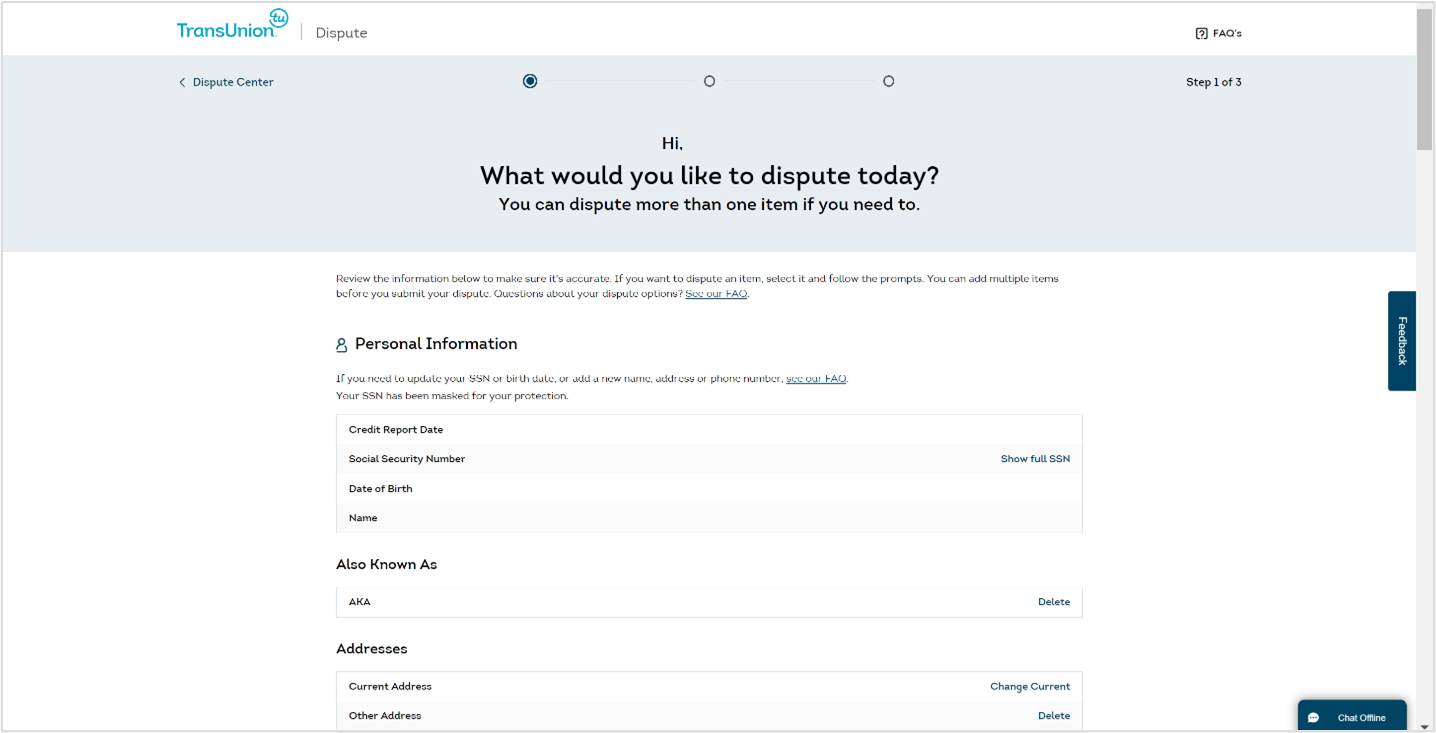

Once you are logged in, you will see a screen that looks like this:

You can click “Get Started” on the upper right square, “Dispute” option. This will take you to a screen that looks like the following:

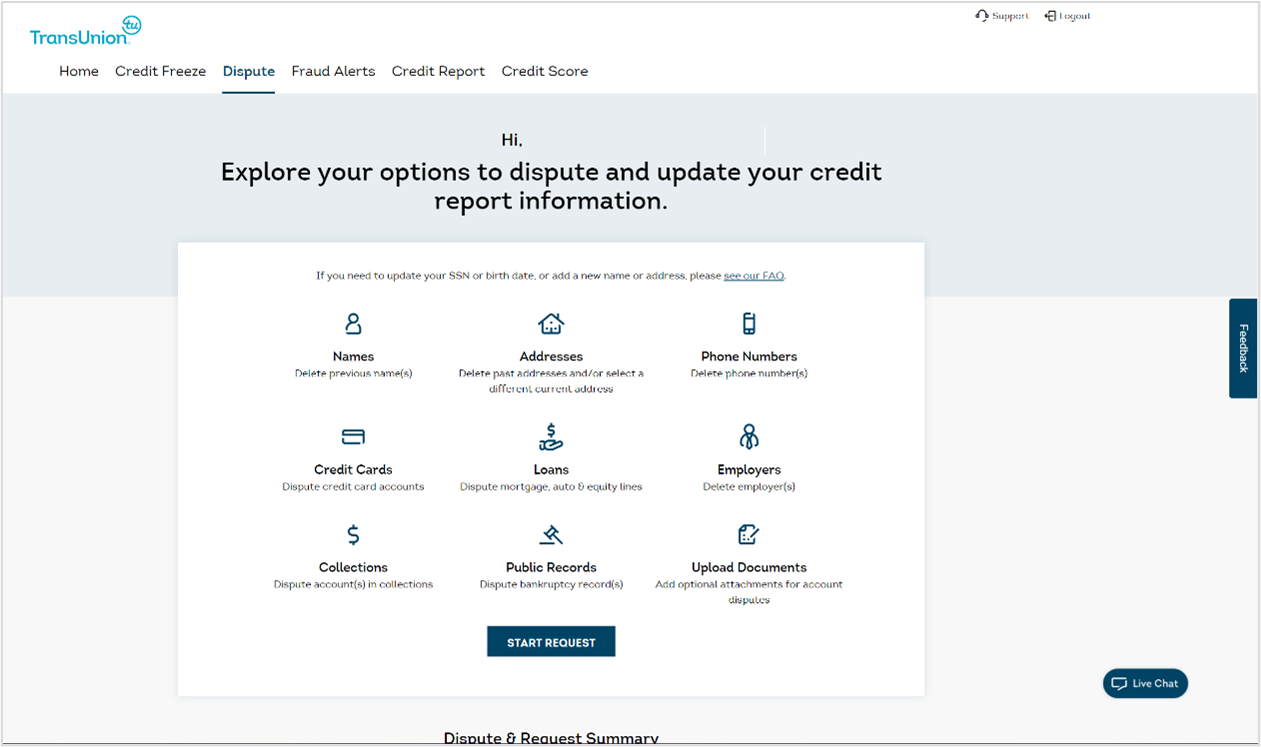

Click on “Start Request” in the middle of page, and after agreeing to an acknowledgment screen, you will have a screen that looks like this below:

You want to make sure that all of your current personal information, Name, Address, and Social, is correct.

I recommend that you remove all of your phone numbers, old addresses, and any employers that show. Believe it or not but less is more when it comes down to your personal information section and what the lenders can cross reference or not. It might surprise you, but this change can have a positive effect on your credit score very quickly.

Next, take a look below at all of the accounts that have derogatory remarks; you can ignore any accounts that are considered “satisfactory.”

For any items that are labeled as “Charge off’s” or similar, you want to dispute them. For the dispute at the first and second prompt that comes up you will want to click “No” and then save and continue.

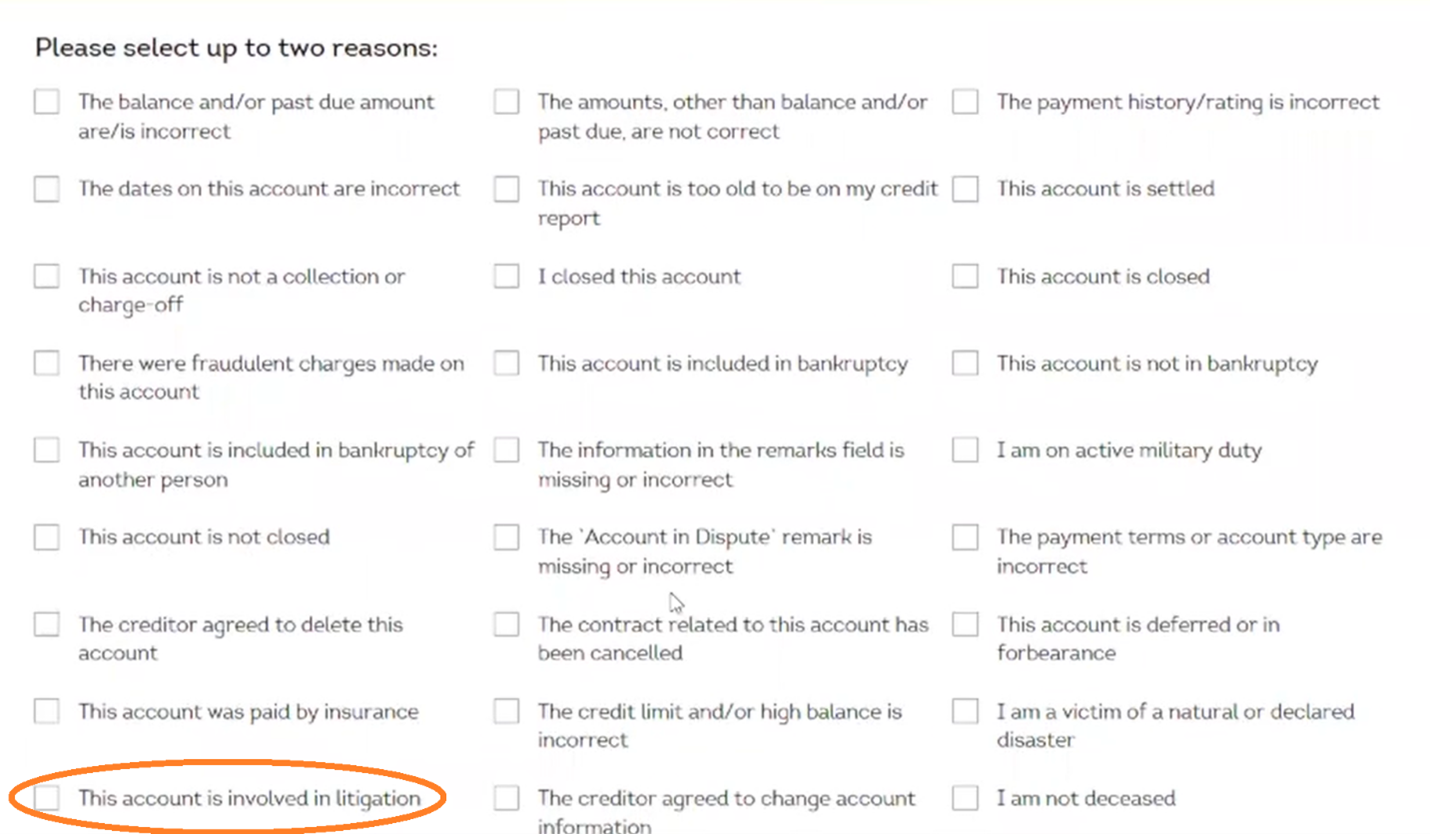

For all disputes, you will be provided a list of items that you can choose from that looks like this:

You only need to click one of the items listed, and it is the one in the bottom-left corner “This account is involved in litigation.”

You will then click “Continue” below, not needing to fill out any more information.

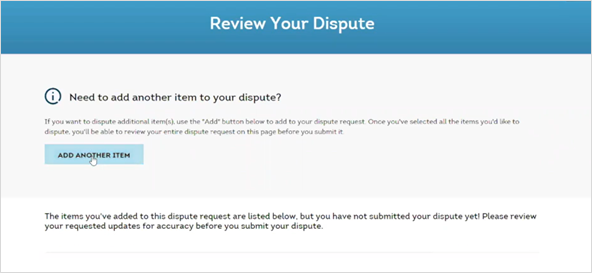

And if you need to add another contested item you can do so.

For any item that you believe should not be on your credit report, you can either click “Delete” or click “Dispute.”

For any derogatory remarks, I would suggest as many as you can, and this is especially good for collections.

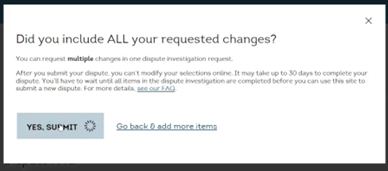

Once you are finished with any and all items, you may click “Submit.”

TransUnion will tell you that they may need 30 days to accomplish your requests.

While disputes may take a little while to process, the deletes are almost always very quick. I have seen results in under 30 seconds once a claim is submitted getting changed instantly by the computer algorithm.

Pro Tip- You can challenge hard inquiries on Equifax, as well as everything else, using a similar backdoor method. However, Equifax will need three points of reference. These are things such as a valid ID, a copy of your social security card with the signature shown, and proof of residency.

Experian will also allow you to challenge everything over the phone, which is the fastest way to see guaranteed results.

If you are interested in having Transunion hard inquiries removed, you will have to go through the sweep process, which involves a little more lengthy procedure and may require obtaining a police report if necessary; however, you can see results typically in 10 - 60 days, and this will provide you with significant success in your credit journey.

© Credit Counsel Elite - All Rights Reserved

Terms & Conditions | Privacy Policy | Earnings Disclaimer | Advertiser Disclosure